NVIDIA Announces Earnings of $2.6 Billion for Q3 2018, Once Again Sets Profit Record

by Nate Oh on November 9, 2017 11:00 PM EST- Posted in

- GPUs

- NVIDIA

- Financial Results

This afternoon, NVIDIA announced its earnings for their 2018 fiscal year’s third quarter, which spans July 31 to October 29, 2017 (and not to be confused with the 2017 calendar year third quarter). Driven largely by sales of Pascal based gaming graphics cards and Volta based datacenter products, NVIDIA posted a record revenue of $2.636 billion, up 32% from a year ago. Gross margin increased by half a percent year-over-year to 59.5% as well. Similar to last quarter, the increase in revenue and gross margin were accompanied with an increase in operating income to $895 million, up 40% from Q3 2017. Overall, net income was reported at $838 million, up 55% year-over-year, with diluted earnings per share at a record $1.33, up 60% year-over-year.

Bringing it together, Q3 2018 is another record quarter for NVIDIA, fueled in part by the seasonally strongest quarter (July to September) for GPU shipments and the PC market as a whole.

| NVIDIA Q3 2018 Financial Results (GAAP) | |||||

| Q3'2018 | Q2'2018 | Q3'2017 | Q/Q | Y/Y | |

| Revenue | $2636M | $2230M | $2004M | +18% | +32% |

| Gross Margin | 59.5% | 58.4% | 59.0% | +1.1% | +0.5% |

| Operating Income | $895M | $688M | $639M | +30% | +40% |

| Net Income | $838M | $583M | $542M | +44% | +55% |

| EPS | $1.33 | $0.92 | $0.83 | +45% | +60% |

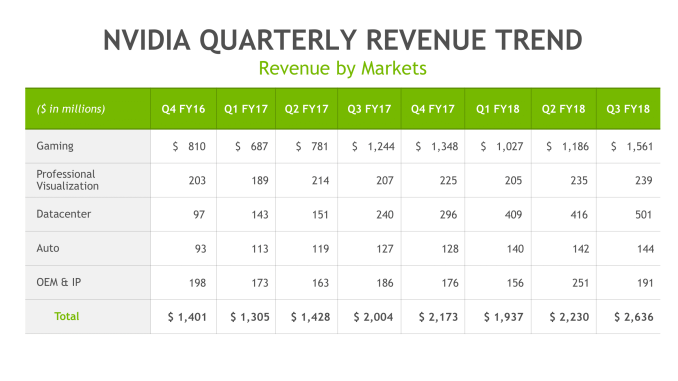

As usual, NVIDIA’s gaming segment provides the lion’s share – around 59% – of the company’s Q3 revenue, riding on PC gaming. Up 25% year-over-year, gaming revenue was reported at $1.561 billion, a figure not to be taken lightly: NVIDIA’s Q3 2018 gaming segment alone earned around 95% of AMD’s total revenue of their positive Q3 2017. Put another way, NVIDIA’s gaming segment earned more than NVIDIA as a whole did back in August 2016 at the end of their Q2 2017. As all GeForce sales are counted in the gaming segment, this growth includes some waning cryptocurrency mining demand that spiked in the second calendar year quarter; as for crypto-specific boards, they are categorized into the OEM and IP segment.

Officially, NVIDIA attributes the gaming revenue growth to continued sales of Pascal based gaming GPUs. While NVIDIA did launch the GTX 1070 Ti last week, with preorders opening in late October, this occurred at the very tail end of their fiscal quarter, and so related revenue would be seen in their Q4 fiscal report.

| NVIDIA Quarterly Revenue Comparison (GAAP) ($ in millions) |

|||||

| In millions | Q3'2018 | Q2'2018 | Q3'2017 | Q/Q | Y/Y |

| Gaming | $1561 | $1186 | $1244 | +32% | +25% |

| Professional Visualization | $239 | $235 | $207 | +2.0% | +15% |

| Datacenter | $501 | $416 | $240 | +20% | +109% |

| Automotive | $144 | $142 | $127 | +1.0% | +13% |

| OEM & IP | $191 | $251 | $186 | -24% | +3.0% |

On the Quadro side of matters, NVIDIA’s professional visualization segment also saw an increase, up 15% year-over-year to $239 million, driven by high-end mobile platforms. While this segment has not grown by the same leaps-and-strides as gaming or datacenter, $239 million is still record quarterly revenue for NVIDIA’s very high margin professional visualization segment.

In light of NVIDIA’s continued AI and high-performance computing (HPC) efforts, shipping their first Volta-based DGX system in September, datacenter continues to be NVIDIA’s second largest market by revenue. Up 109% year-over-year, datacenter revenue was reported at a record $501 million, breaking the half-billion dollar mark. NVIDIA stated that the growth reflected shipments of Volta based GPUs, as well as increased hyperscale and cloud demand for deep learning training and GPU compute. Volta continues to ramp up, having started the previous quarter. Comparable to last quarter, this puts datacenter at just above 19% of their total revenue. Though still far from NVIDIA's gaming revenues, the datacenter business is at this point the darling of the company, as the massive growth potential for this market and its high margin outlook is what's been fueling NVIDIA's own growth for the past two years.

The OEM and IP segment reported the most modest gains, up 3% year-over-year and down 24% sequentially. The quarter-to-quarter sequential decrease is largely due to lessening mining demand, and NVIDIA commented that cryptomining boards accounted for $70 million in Q3 as opposed to $150 million in Q2.

Last, and for this quarter the least, automotive revenue was up 13% year-over-year to total at a record $144 million, primarily infotainment modules, but also including production DRIVE PX platforms and self-driving car development agreements. Along with revenue from Nintendo Switch SoC modules, this contributed to a 26% sequential and 74% year-over-year increase for Tegra revenue.

Taking a step back, the past two years have seen the gaming and datacenter segments act as the main drivers for this kind of quarterly growth. That being said, this fiscal year quarter has seen that rapid increase slow down compared to recent quarters.

Q3 2018 also saw NVIDIA put $462 million to research and development, up from $373 million in Q3 2017.

For Q4 2018, NVIDIA looks to set a record year in 2017, expecting total Q4 revenue between $2.59 and $2.70 billion, coupled with gross margins between 59.2% and 60.2%.

Source: NVIDIA

22 Comments

View All Comments

jjj - Thursday, November 9, 2017 - link

Nvidia's valuation is absurdly high, good time for them to buy someone like AMD or Mediatek.ViRGE - Friday, November 10, 2017 - link

NVIDIA doesn't really need AMD's GPU business, and I dare say they likely don't want the semi-custom business either since it's so low margin. The only reason to buy AMD would be the CPU business. Which would make a lot of sense right now to counter Intel's new dGPU plans.However 10B+premium is a lot to pay for that business. The problem being that both AMD and NVIDIA are overvalued right now, though for different reasons.

jjj - Friday, November 10, 2017 - link

AMD's GPU business would be divested ofc, egulators wouldn't ok the deal otherwise. Semi-custom can be kept or transitioned to another model but Nvidia does want consoles.AMD's valuation is low as they have a lot of growth ahead. They had 3-4% revenue share in PC and nothing really in server. Wait 2 years and they'll be worth a lot more than 20-30B. The main problem is that the PC reaches 0 units in less than a decade but this would be a defensive move against Intel and AMD going after the low and mid discrete market with integrated GPUs (with advanced packaging). Solutions like the recently announced Intel+AMD mutant would make it hard for Nvidia to compete, especially since the system memory is in play too- if the cPU has access to the VRM, the OEM can save a bunch on DRAM. They might end up isolated to high end only and that's risky, would be betting the farm on machine learning.

Buying Mediatek would be more forward looking but not sure Nvidia can manage such a business and they might ruin it quickly -Mediatek needs to be humble and work hard for every cent while Nvidia is a bit of a diva.

Jumangi - Friday, November 10, 2017 - link

Pretty sure that’s not an option. I believe there’s a clause with AMDs x86 license that if anyone buys them it’s void so nobody else can ever get the rights.Yojimbo - Friday, November 10, 2017 - link

"Pretty sure that’s not an option. I believe there’s a clause with AMDs x86 license that if anyone buys them it’s void so nobody else can ever get the rights."Yes, but Intel also relies on AMD patents. My question is whether Intel can not operate without those AMD patents, such that it would force them to sign a new patent cross license agreement with whoever buys AMD. Additionally, if Intel were to deny the right to make x86 processors to the only other major x86 process manufacturer, I wonder if perhaps governments would be inclined to investigate them for anti-trust violations, since x86 processors account for such a large majority of the market.

Yojimbo - Friday, November 10, 2017 - link

"However 10B+premium is a lot to pay for that business. The problem being that both AMD and NVIDIA are overvalued right now, though for different reasons."If you think both AMD's and NVIDIA's currencies are overvalued then you shouldn't have a problem with NVIDIA paying a reasonable premium over AMD's current share price for a buy out using NVIDIA's stock as currency. If AMD were greatly overvalued with respect to NVIDIA then you might argue that NVIDIA would get bad value by buying AMD. If NVIDIA were overvalued with respect to AMD, then if you were an AMD shareholder you might demand a higher purchase price or demand that you receive cash for your shares instead of NVIDIA stock.

yannigr2 - Friday, November 10, 2017 - link

They can't buy them and they don't need any of them.They can't buy AMD because all AMD's valuation is in the x86 license that Intel will not agree to be transfered to Nvidia. And Nvidia doesn't really need GCN.

They have Tegra for ARM, they don't need Mediatek that just produces low cost ARM SOCs that everyone sees as inferior to anything from Samsung or Qualcomm.

What Nvidia needs to do is hit the gas on it's Denver cores, because AMD and Intel are accelerating on the x86 platform, seeing that the ARM platform is closing the gap fast.

yannigr2 - Friday, November 10, 2017 - link

Meaning, about Denver, that Nvidia needs multicore SOCs with Denver cores running Windows 10 as Snapdragon 835 as fast as possible.jjj - Friday, November 10, 2017 - link

Would help if you would abstain on matters you are not informed at all.They can buy AMD, the lawyers will figure it out, that's not an issue.

Mediatek is a semiconductor giant and it would allow Nvidia to diversify andsurvive in consumer in current devices and future device. Nvidia has tried at failed. Your opinion on Mediatek is false and shaped by Qualcomm's marketing, shame on you for being so gullible. The way Mediatek has tortured Qualcomm is many times more than anyone else on this planet has been able to achieve and that includes Nvidia, Intel, Broadcom, TI, Marvel, Samsung, Huawei, Spreadtrum, ST and more. Qualcomm was sheltered by its illegal patent practices or Mediatek would be the market leader today in phones. Nvidia is likely not competent enough to run it , otherwise they should buy it.

yannigr2 - Friday, November 10, 2017 - link

It would help if you just abstain on matters you are not informed at all. Except if you have figure it out already. Maybe you should send your solution to Nvidia's lawyers and open their eyes.As for Mediatek, it must be the first time I see a Mediatek fanboy. You are a rare occasion. At least on western tech sites. There are plenty of phones out there with two versions, one with a Mediatek SOC and one with Qualcomm. Anyone looking only at the looks and price of the phone, will go with the cheaper Mediatek option. Anyone cared about performance will spent the extra cash for the Qualcomm version. Mediatek is good for the ARM SOC market as much as AMD is good for the GPU and x86 market. But unfortunately they doin't really innovate as AMD is doing in it's markets. Mediatek just throws more clusters and cores in their SOCs. Nothing more. They even hit the brakes in their hi end development lately. It's Helio X30 looks to be something no one cares to use.

By the way. If I am not mistaken you are an Intel+Nvidia fanboy. Strange to be with Mediatek in this case. :p